san francisco payroll tax rate

Determine total San Francisco payroll expenses. City and County of San Francisco.

How To Calculate Payroll Taxes For Your Small Business

The following requirements are in place for reporting and tax purposes.

. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments. Bonuses and earnings from stock options are taxed at a flat rate of 1023 while all other supplemental wages are taxed at a flat rate of 66. To compute the tax.

Determine non-taxable San Francisco payroll expenses. In California these supplemental wages are taxed at a flat rate. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last day of February for the prior calendar year Jan.

The Homelessness Gross Receipts Tax imposes an annual tax in addition to the existing GRT on San Francisco taxable gross receipts above 50000000. Apportionment for this Section is 50 Real Personal Tangible and Intangible Property and 50 based on payroll Section 9535c San Francisco gross receipts may be reduced by amounts paid in the tax year to a subcontractor possessing a valid business registration certificate with the City to the extent those amounts were included in the amount your business allocated to the. The amount of such tax for Associations shall be 1½ percent of the payroll expense of such Association plus 1½ percent of the total distributions.

These taxes will be reflected in the withholding from your paycheck if applicable. Payroll Expense Tax Rate. The tax rate reaches its maximum level when the ratio reaches 600 to 1 with a maximum tax on payroll of 24 percent or a surcharge on the gross receipts tax of up to 6 percent.

The 2017 gross receipts tax and payroll expense tax return is due February 28 2018. Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the Federal income tax. Repeal of payroll expense tax.

Tax Rate Allocation The tax rate is 15 percent of total payroll expenses. The City of San Francisco City has issued the payroll expense tax rate for 2019 which is unchanged from the prior year at 0380. The additional tax would either increase the Gross Receipts Tax or the Administrative Office Tax whichever applies to that business and is effective January 2022.

For more information about San Francisco 2021 payroll tax withholding please call this phone number. Updated Sep 17 2020 727pm PDT. Lean more on how to submit these installments online to comply with the Citys business and tax regulation.

With San Francisco companies having most of their employees working from their homes often outside the city employers might be overpaying San Francisco business. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an individual paid more than 200000 are set by the IRS. Nonresidents who work in San Francisco also pay a local income tax of 150 the same as the local income tax paid by residents.

The tax rate for 2022 is 14. They ask that you obtain an EIN withhold taxes verify your workers eligibility before hiring and register them with the state after they begin working for you. Administrative Office Tax For any business maintaining an administrative office in the city the tax is graded based on companies CEO pay ratio 04 of companies total taxable payroll expense attributable to San Francisco for ratios above 1001 up.

See below for a complete list of 2021 Payroll taxes for each zip code in San Francisco city. Certain taxpayers engaged in administrative office business activities are not subject to the GRT or the payroll tax but instead pay a 14 tax on total payroll expense. The San Francisco Office of the Controller City and County of San Francisco announced that for tax year 2018 the Payroll Expense Tax Rate is 038 down from 0711 for 2017.

The progressive tax rate ranges between 01 to 06 and is assessed on gross receipts sourced to San Francisco as determined for Gross Receipts Tax purposes. However each state specifies its own tax rates which we will. The Administrative Office Tax AOT is a 14 percent tax on the San Francisco payroll expense of a person or combined group engaging in business within San Francisco as an administrative office if.

The rate of the payroll expense tax shall be 1½ percent. The payroll expense tax rate for tax year 2017 is 0711 down from 0829 for tax year 2016. The amount of a persons liability for the payroll expense tax shall be the product of such persons taxable payroll expense multiplied by 0015.

City and County of San Francisco Treasury and Tax Collector website. San Franciscos payroll expense tax was set to fully phase out in 2018 after the phase-in of the Citys gross receipts tax. Effective January 1 2022 businesses subject to the San Francisco Administrative Office Tax AOT must pay an additional annual Overpaid Executive Tax OET of 04 to 24 on their payroll expense in San Francisco when their highest paid managerial executive earns more than 100 times the median compensation paid to employees in San Francisco.

Payroll tax revenues are derived from a tax on the payroll expense of persons and associations engaging in business in San Francisco. Both employers and employees are responsible for payroll taxes. Like the GRT the tax rate depends on the type of business activity from which the gross receipts are earned as follows.

The registration fee ranges from 17555 to 40959 based on payroll expense attributable to San Francisco. Nevertheless the City ordinance enacting the gross receipts tax allows the San Francisco Controller to retain the. Proposition F repeals the payroll expense tax as of January 1 2021.

2 Otherwise the tax base is the same as the existing GRT. The tax is calculated as a percentage of total payroll expense based on the tax rate for the year. Every person engaged in business in San Francisco as an administrative office pays a tax and a fee based on payroll expense attributable to San Francisco.

13 San Francisco Business and Tax Regulations Code Article 12-1-A 954g 14 San Francisco Business and Tax Regulations Code Article 12-1-A 953. The taxpayer may calculate the amount of compensation to owners of the entity subject to the Payroll Expense Tax or the taxpayer may presume that in addition to amounts reported on a W-2 form the amount subject to the payroll expense tax is for each owner an amount that is two hundred percent 200 of the average annual compensation paid to on behalf of or for the. Thu 07242014 - 1310.

State Payroll Taxes What You Need To Know Homebase

Tax Forms Tax Forms Irs Taxes Tax

2022 Federal State Payroll Tax Rates For Employers

2022 Federal State Payroll Tax Rates For Employers

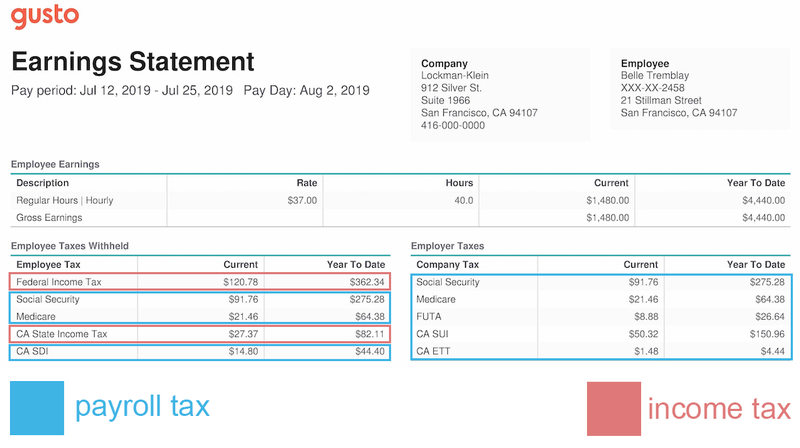

Payroll Tax Vs Income Tax What S The Difference

Social Security Administration Announces 2022 Payroll Tax Increase Eri Economic Research Institute

Payroll Tax Vs Income Tax What S The Difference

Online Payroll Services For Startups Payroll Business Tracking Expenses

How To Calculate Payroll Taxes For Your Small Business

How To Calculate Payroll Taxes For Your Small Business

Due Dates For San Francisco Gross Receipts Tax

Payroll Tax Specialist Salary Comparably

Payroll Taxes Are Taxes Which Are Imposed On Employers When They Pay Employees And On Employee Wages By Federal State And In 2022 Llc Taxes Business Tax Payroll Taxes

Different Types Of Payroll Deductions Gusto

How Do I Get My California Employer Account Number

2021 Wage Base Rises For Social Security Payroll Taxes

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time